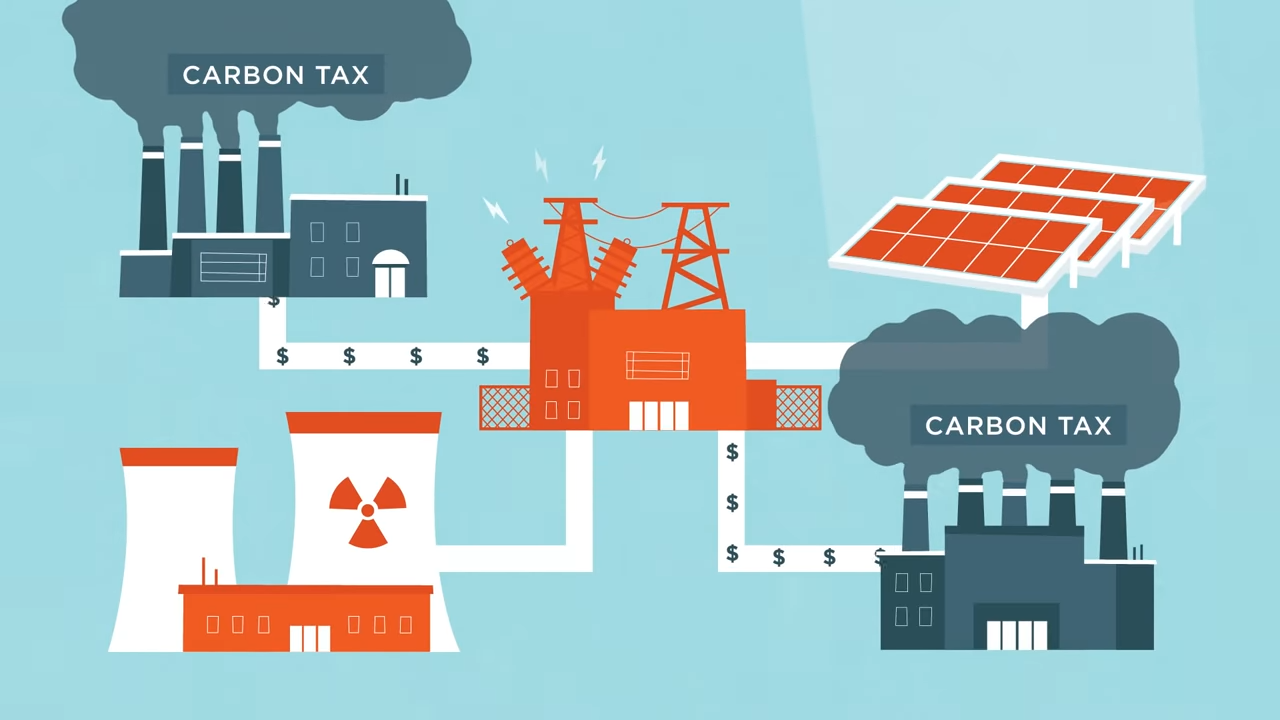

Is a carbon tax an efficient way to reduce greenhouse gas emissions? Two experts debate the issue.

Jordan McGillis

Manhattan Institute

Jordan McGillis is a Paulson Policy Analyst at the Manhattan Institute. Before joining MI, Jordan was the Deputy Director of Policy at the Institute for Energy Research, where his work focused on the intersection of energy policy with geopolitics, environmental policy, and urbanism. At MI, his work touches on a range of issues including energy, environment, housing, and transportation. McGillis’s work has appeared in National Review, The American Spectator, Breakthrough Journal, and City Journal.

Alex Muresianu

Tax Foundation

Alex Muresianu is a federal analyst at the Tax Foundation, after previously working on the federal team as an intern in the summer of 2018 and as a research assistant in summer 2020. He attended Tufts University, graduating with a degree in economics and minors in finance and political science in February 2021. He also worked for the Pioneer Institute in 2019, spent a summer as a journalism intern at Reason magazine, and written op-eds for various print and online publications.

With climate change gaining prominence as a major political issue, some experts are proposing a carbon tax as a possible compromise to mitigate greenhouse gas emissions. But what exactly is a carbon tax? Eric Miller moderates this Scholar’s Mate debate.